SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Rule 14a-101

Schedule 14A Information

| | | | | | | | |

| | |

|

SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Securities Exchange Act of 1934Commission Only (as permitted by Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | | | | | | | |

Filed by the Registrant ☑

|

|

Filed by a Party other than the Registrant ☐

|

|

Check the appropriate box:

|

☑

| Preliminary Proxy Statement

|

☐

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

☐

| Definitive Proxy Statement

|

☐

| Definitive Additional Materials

|

☐

| Soliciting Material Pursuant to §240.14a-12

|

|

|

Callon Petroleum Company |

(Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | |

Payment of Filing Fee (Check the appropriate box): |

☑

| No fee required.

|

☐

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| (1)

| Title of each class of securities to which transaction applies:

|

| (2)

| Aggregate number of securities to which transaction applies:

|

| (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4)

| Proposed maximum aggregate value of transaction:

|

| (5)

| Total fee paid:

|

| | |

☐

| Fee paid previously with preliminary materials.

|

☐

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| (1)

| Amount Previously Paid:

|

| (2)

| Form, Schedule or Registration Statement No.:

|

| (3)

| Filing Party:

|

| (4)

| Date Filed:

|

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies:

______________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

______________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

______________________________________________________________________________________

(5) Total fee paid:

______________________________________________________________________________________

CALLON PETROLEUM COMPANY

200 NORTH CANAL STREET

NATCHEZ, MISSISSIPPI 39120

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the

filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, of the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

______________________________________________________________________________________

(3) Filing Party:

______________________________________________________________________________________

(4) Date Filed:

______________________________________________________________________________________

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, Texas 77042

NOTICE OF

THE 2016 ANNUALSPECIAL MEETING OF

STOCKHOLDERSTO BE HELD THURSDAY, MAY 12, 2016

To Our Stockholders:

Notice is hereby given and you are cordially invited to attend the2016 Annual MeetingSHAREHOLDERS

NOTICE IS HEREBY GIVEN that a special meeting of Stockholders (the “Annualshareholders (the “Special Meeting”) of Callon Petroleum Company (“Callon,” the “Company,” “us,“our,” “we,” “our”“we” or like terms), a Delaware corporation, which “us”) will be held in Natchez, Mississippi, on Thursday, May 12, 2016,, 2021 at 9:00 a.m.[a.m. // p.m.] Central Daylight Time (“CDT”)at , for the purpose of considering and taking the following action, which is described in the Grand Ballroomaccompanying Proxy Statement:

To vote, for purposes of complying with Rule 312.03(b) of the Natchez Grand Hotel, 111 Broadway Street, Natchez, Mississippi 39120,New York Stock Exchange (“NYSE”) Listed Company Manual, upon a proposal (the “Issuance Proposal”) to considerapprove the issuance to Chambers Investments, LLC, a Delaware limited liability company (“Kimmeridge”), of 5,512,623 shares of common stock, par value $0.01, of the Company (the “Common Stock” and such shares to be issued the “New Common Stock”).

Callon will transact no other business at the Special Meeting, except such business as may properly be brought before the Special Meeting or any adjournments or postponements thereof by or at the direction of the Callon board of directors (the “Board”) in accordance with Callon’s bylaws.

The Board has unanimously determined that the issuance to Kimmeridge of the New Common Stock is in the best interests of Callon and its shareholders. The Board unanimously recommends that you vote on“FOR” the following proposals:Issuance Proposal. | ·

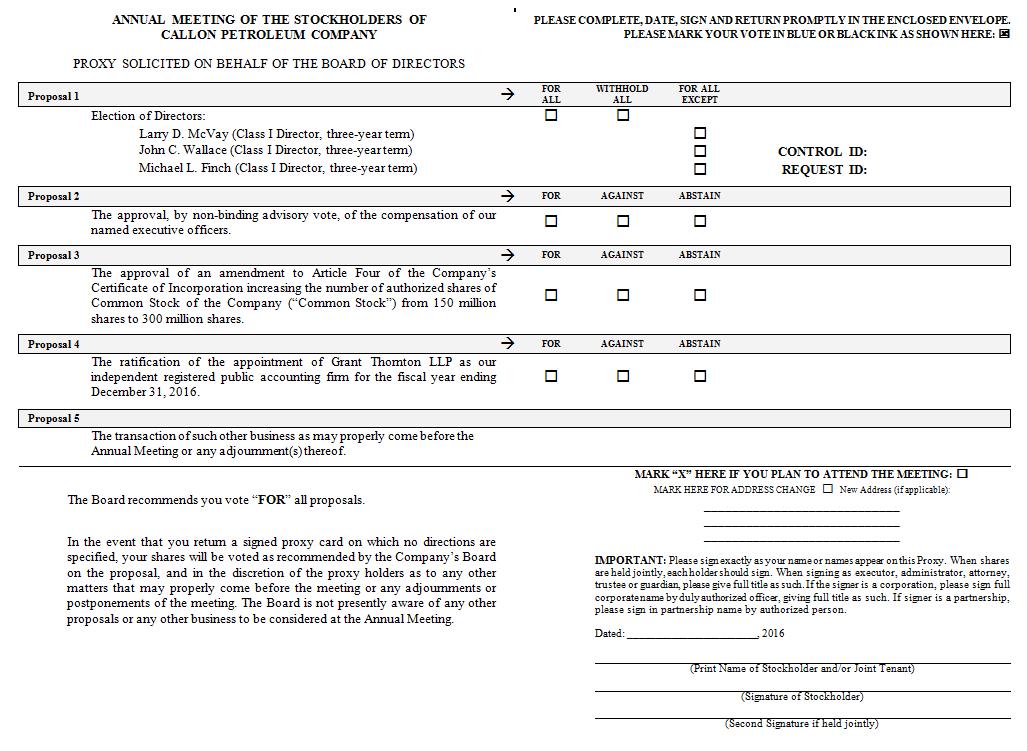

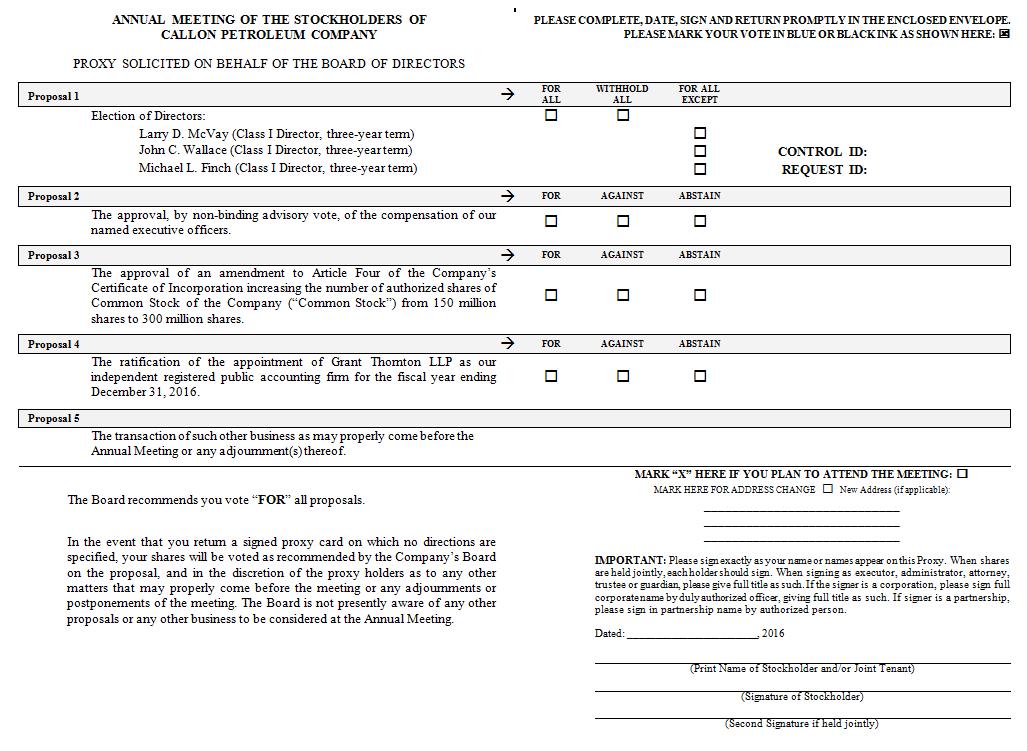

| | The election of three Class I Directors, Messrs. Larry D. McVay, John C. Wallace and Michael L. Finch, for a three-year term;

|

| ·

| | The approval, by non-binding advisory vote, of the compensation of our named executive officers (“NEOs”);

|

| ·

| | The ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016;

|

| ·

| | The approval of an amendment to Article Four of the Company’s Certificate of Incorporation increasing the number of authorized shares of Common Stock of the Company (“Common Stock”) from 150 million shares to 300 million shares; and

|

| ·

| | The transaction of other business as may properly come before the Annual Meeting or any adjournment(s) thereof.

|

We describe these proposals in detail within the accompanying proxy materials. Only holdersshareholders of record as of our common stock at the close of business on March 18, 2016, 2021 (the “Record Date”), are entitled to receive notice of and to attend the Annual Meeting and to vote on the above listed matters. Beginning on or about April 1, 2016, we mailed a Notice Regarding the Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice contained instructions on how to access the proxy statement and related materials online and how to vote your shares. Instructions for requesting a paper copy of the proxy materials are contained in the Notice. A list of stockholders entitled to vote at the Annual Meeting will be available at our office at 200 North Canal Street, Natchez, MS 39120 during normal business hoursSpecial Meeting.

On August 3, 2021, we entered into an Exchange Agreement with Kimmeridge, pursuant to which we agreed to issue and deliver to Kimmeridge, subject to shareholder approval, the New Common Stock in exchange for a period$197.0 million aggregate principal amount of ten daysthe Company’s 9.00% Second Lien Senior Secured Notes due 2025 held by Kimmeridge, including in respect of any accrued and unpaid interest (the “Exchange Agreement”). The Exchange Agreement is described in the accompanying Proxy Statement and is attached thereto as Annex A. We are seeking shareholder approval of the Issuance Proposal in order to comply with Rule 312.03(b) of the NYSE Listed Company Manual (“Rule 312.03(b)”). Under Rule 312.03(b), shareholder approval is required prior to any issuance or sale of common stock in any transaction or series of related transactions (i) to a substantial security holder of the meetingcompany (a “Related Party”) if the number of shares of common stock to be issued exceeds either 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance or (ii) when a Related Party has a 5% or greater interest, directly or indirectly, in the company or in the consideration to be paid in the transaction or series of related transactions, and the present or potential issuance of common stock could result in an issuance that exceeds either 5% of the number of shares of common stock or 5% of the voting power outstanding before the issuance. As described further in the accompanying Proxy Statement, due to Kimmeridge’s beneficial ownership of approximately 13.4% of our Common Stock (as of September 3, 2021), Kimmeridge is a Related Party for purposes of Rule 312.03(b).

Pursuant to the Exchange Agreement, Kimmeridge has agreed to vote all shares of Common Stock beneficially owned by it as of the Record Date in favor of the Issuance Proposal. In connection with the execution of the Exchange Agreement, each of the Company’s executive officers and directors also entered into a Voting Agreement, dated as of the date of the Exchange Agreement (the “Voting Agreement”). On the terms and conditions set forth in the Voting Agreement, our executive officers and directors agreed to vote all of the shares of Common Stock over which they have voting power (representing in the aggregate approximately 2% of the Company’s total outstanding voting power) in favor of the Issuance Proposal. The Voting Agreement is described in the accompanying Proxy Statement and is attached thereto as Annex B.

Additionally, pursuant to those certain purchase and sale agreements, dated as of August 3, 2021, between the Company, Callon Petroleum Operating Company and Primexx Resource Development, LLC and BPP Acquisition, LLC, respectively (collectively, “Primexx” and such transactions contemplated by such purchase and sale agreements, the “Primexx Transaction”), Primexx has agreed to vote all shares of Common Stock over which they will alsohave voting power (estimated to be available for inspection9.19 million shares, subject to purchase price adjustments pursuant to the purchase and sale agreements) in favor of the Issuance Proposal. In the aggregate, the foregoing voting agreements represent approximately 16 million, or approximately 30%, of the shares anticipated to be outstanding on the Record Date.

It is important that your shares be represented at the Annual Meeting.Special Meeting, regardless of the number of shares you may hold.

Whether or not you plan to attend, the meeting, please vote electronically viausing the Internet, or by telephone or please complete, sign, date and returnby mail, in each case by following the instructions in the accompanying proxy cardProxy Statement. This will not prevent you from voting your shares in the enclosed postage-paid envelope as soon as possible. See “Information About Voting and The Meeting” in the proxy statement for more details.We look forward to seeing youperson at the meeting.

Special Meeting if you are present.

By Order of the Board of Directors,

By: /s/ B.F. Weatherly

Natchez, Mississippi B.F. Weatherly

April 1, 2016Corporate Secretary

1

L. Richard FluryChairman of the Board

YOUR VOTE IS IMPORTANT!

Dated: , 2021

Important Notice Regarding the Availability of Proxy Materials for the

Annual Special Meeting of Stockholders to be held on May 12, 2016:

This proxy statement, 2021: this Proxy Statement and our 2015 Annual Report on Form 10-Kthe accompanying Proxy Card are available electronically at

https://www.iproxydirect.com/CPE [www.[●].com].

This Proxy Statement and

www.callon.comIf you have any questionsthe accompanying Proxy Card are being mailed to shareholders on or need assistance voting yourabout , 2021. The Proxy Card includes instructions on how to access the proxy materials over the Internet, how to request additional printed copies of these materials, and how to vote shares please callof our proxy solicitor:

Morrow & Co., LLC

470 West Avenue - 3rd Floor

Stamford, CT 06902

Banks and Brokerage Firms, please call (203) 658-9400.

Stockholders, please call toll free (800) 414-4313.

PROXY SUMMARY

This summary is included to provide an introduction and overview ofCommon Stock. In addition, by following the information containedinstructions in the Proxy Statement. This is a summary only and highlights information contained elsewhereCard or other voting instruction card, shareholders may request to receive proxy materials in this Proxy Statement. This summary does not contain allprinted form by mail or electronically by e-mail on an ongoing basis.

Table of

the information you should consider and is not a form for voting. You should read the entire Proxy Statement carefully before voting. 2016 Annual Meeting of Stockholders

Contents

Date and Time:

May 12, 2016, at 9:00 a.m., Central Daylight TimeLocation:Natchez Grand Hotel, 111 Broadway Street, Natchez, Mississippi 39120

Record Date:March 18, 2016

Proxy Voting:Stockholders as of the close of business on the Record Date are entitled to vote. Each share of Common Stock is entitled to one vote at the Annual Meeting

Voting Matters and Board Recommendation

| | | | | |

| DATE, TIME AND PLACE OF THE SPECIAL MEETING | | | | |

Proposal

QUESTIONS AND ANSWERS | | Board

Recommendation

| |

No. 1: Election of Three Director Nominees to Serve for a Three-Year Term Expiring in 2019

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | | | FOR

| |

No. 2: Advisory Vote to Approve Named Executive Officer Compensation

WHERE YOU CAN FIND MORE INFORMATION | | | FOR

| |

No. 3: Amendment to the Certificate of Incorporation to Increase Authorized Shares of Common Stock from 150 million to 300 million

Information Incorporated by Reference | | | FOR

| |

THE ISSUANCE PROPOSAL | |

| Overview and Reason for the Issuance Proposal | |

| The Voting Agreements | |

| Registration Rights Agreement | |

| BENEFICIAL OWNERSHIP OF SECURITIES | 14 |

| OTHER MATTERS | 17 |

| Requirements, including Deadlines, for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders | 17 |

List of Shareholders Entitled to Vote at the Appointment of Grant Thornton, LLC as the Company’s Independent registered Public Accounting Firm for 2016Special Meeting | 18 |

| Expenses Relating to this Proxy Solicitation | 18 |

| ANNEX A EXCHANGE AGREEMENT | FOR

A-1 |

| ANNEX B VOTING AGREEMENT | |

Executive Compensation Highlights

Our Board has a “pay-for-performance” philosophy and recognizes the leadership of Mr. Fred L. Callon, our Chairman, President and Chief Executive Officer, and our other executive officers in contributing to the Company’s success in 2015. Our compensation program is designed to reward, in both the short-term and the long-term, performance that contributes to the implementation of our business strategies, maintenance of our culture and values and the achievement of our objectives. In addition, we reward qualities that we believe help achieve our business strategies, such as teamwork, individual performance in light of general economic and industry-specific conditions, relationships with shareholders and vendors, the ability to manage and enhance production from our existing assets, the ability to explore new opportunities to increase oil and natural gas production, the ability to identify and acquire additional acreage, the ability to increase year-over-year proved reserves, the ability to control unit production costs, level of job responsibility, industry experience and general professional growth.

| ·

| | As a result of the achievements listed above, the Committee awarded bonuses above target for our NEOs for 2015 performance;

B-1 |

| ·

| | In May 2015, the Committee granted long-term incentives to our NEOs, 60% of which were tied to total stockholder return, or TSR;

|

| ·

| | The Committee certified the results of the 2013 grants of TSR phantom shares, which measured Callon’s TSR against its peers for the 2013-2015 time period. Callon ranked first out of 13 peers, resulting in 200% of the targeted number of phantom shares vesting; and

|

| ·

| | No changes were made to NEO base salaries in 2015.

|

In 2015, approximately 96% of the shares voted at last year’s annual meeting approved our 2014 executive compensation by supporting our “Say-on-Pay” proposal.

Key Elements of our Executive Compensation

| ·

| | “Pay-for-Performance” philosophy linking compensation directly to performance, with a significant portion of total annual compensation placed “at risk”

|

| ·

| | Annual cash bonus incentive tied to the achievement of specified Company performance targets

|

| ·

| | Long-term equity or equity-based incentive awards and performance share program based on relative TSR

|

| ·

| | Other benefit plans and programs, such as retirement, health benefits and severance protection

|

Governance Highlights

| ·

| | Board meetings in 2015: 5

|

| ·

| | Committee meetings: Audit – 9; Compensation – 5; Nominating and Corporate Governance – 3; Strategic Planning and Reserves – 3

|

| ·

| | 7 out of 8 Directors are independent and committees are comprised entirely of independent Directors

|

| ·

| | Majority vote standard in election of Directors

|

| ·

| | Classified Board of Directors with staggered terms

|

| ·

| | Director and Officer stock ownership guidelines

|

| ·

| | Elimination of tax gross-ups

|

| ·

| | “Double Trigger” severance agreements with fixed term

|

| ·

| | Policy prohibiting hedging transactions [related to stock ownership positions]

|

| ·

| | Recently updated governance documents, such as the Corporate Governance Guidelines, Code of Business Conduct and Ethics, and Board Committee Charters.

|

PROXY STATEMENT

________________________

CALLON PETROLEUM COMPANY

200 North Canal Street

Natchez, Mississippi 39120

(601) 442-1601

2016 ANNUAL

PROXY STATEMENT FOR SPECIAL MEETING OF

STOCKHOLDERSTHURSDAY, MAY 12, 2016

INFORMATION CONCERNING SOLICITATION AND VOTING

WeSHAREHOLDERS

TO BE HELD ON , 2021

You are providing youreceiving this proxy statement in connection with(the “Proxy Statement”) and the solicitationaccompanying proxy card or other voting instruction card (the “Proxy Card”) because you own shares of proxies by our board of directors (the “Board” or individually “Director” and collectively “Directors”common stock, par value $0.01 (“Common Stock”) to be voted at the 2016 annual meeting (the “Annual Meeting”) of stockholders, of Callon Petroleum Company (“Callon,” the “Company,” “us,“our,” “we,“we” or “us”) that entitle you to vote at a special meeting of shareholders (the “Special Meeting”). Callon’s board of directors (the “Board”) is soliciting proxies from shareholders entitled to vote at the Special Meeting. By use of the Proxy Card, you can vote even if you do not attend the Special Meeting. This Proxy Statement describes the matter on which you are being asked to vote and provides information on this matter so that you can make an informed decision. These proxy materials are being distributed and/or made available to shareholders on or about , 2021.

DATE, TIME AND PLACE OF THE SPECIAL MEETING

We will hold the Special Meeting on , 2021 at [a.m. // p.m.] Central Daylight Time at .

The Board has fixed the close of business on , 2021 as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Special Meeting. Each shareholder will be entitled to one vote for each share of Common Stock held as of the Record Date on the matter to come before the Special Meeting and may vote in person at the Special Meeting, via Internet, by telephone or by proxy authorized in writing.

QUESTIONS AND ANSWERS

Q: What is the purpose of the Special Meeting?

A: At the Special Meeting, shareholders will act upon a proposal (the “Issuance Proposal”) to approve the issuance to Chambers Investments, LLC, a Delaware limited liability company (“Kimmeridge”), of Common Stock of the Company. On August 3, 2021, we entered into an Exchange Agreement with Kimmeridge (the “Exchange Agreement”), pursuant to which we agreed to issue and deliver to Kimmeridge, subject to shareholder approval, 5,512,623 shares of Common Stock (such shares to be issued, the “New Common Stock”) in exchange for $197.0 million in aggregate principal amount of the Company’s 9.00% Second Lien Senior Secured Notes due 2025 (the “Second Lien Notes”) held by Kimmeridge, including in respect of any accrued and unpaid interest. Please see page 12 for information on the exchange valuation. The Exchange Agreement is attached hereto as Annex A.

As described in more detail below, in accordance with the applicable NYSE rules, the Company is calling the Special Meeting to consider and vote on the Issuance Proposal.

Q: Who is Kimmeridge?

A:Chambers Investments, LLC is a private investment vehicle managed by Kimmeridge Energy Management Company, LLC (“Kimmeridge EMC”), an energy private equity firm focused on making direct investments in unconventional oil and gas assets in the United States. Kimmeridge is the holder of $197.0 million in aggregate principal amount of the Company’s Second Lien Notes, issued pursuant to the Indenture, dated as of September 30, 2020 (the “Second Lien Notes Indenture”), by and among the Company, the subsidiary guarantors named therein and U.S. Bank National Association, as trustee and collateral agent. As of September 3, 2021, Kimmeridge EMC beneficially owned 6,188,157 shares of Common Stock of the Company. Kimmeridge’s current holdings in the Company’s Second Lien Notes and all but 602,503 shares of Common Stock were obtained as part of concurrent transactions agreed to in September 2020 whereby Kimmeridge purchased Second Lien Notes, warrants for Common Stock, and an overriding royalty interest

in substantially all Callon-operated oil and gas leaseholds as of the effective date of such transactions. Kimmeridge’s remaining shares of Common Stock were purchased in the open market. It is headquartered at 412 West 15th Street, 11th Floor, New York, NY 10011. Neither Kimmeridge nor any of its affiliated entities has Board representation or any other governance rights with respect to the Company.

Q: Why is shareholder approval of the issuance of the New Common Stock required?

A:We are seeking shareholder approval of the Issuance Proposal in order to comply with Rule 312.03(b) of the New York Stock Exchange (“NYSE”) Listed Company Manual (“Rule 312.03(b)”). Under Rule 312.03(b), shareholder approval is required prior to any issuance or sale of common stock in any transaction or series of related transactions (i) to a substantial security holder of the company (a “Related Party”) if the number of shares of common stock to be issued exceeds either 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance or (ii) when a Related Party has a 5% or greater interest, directly or indirectly, in the company or in the consideration to be paid in the transaction or series of related transactions, and the present or potential issuance of common stock could result in an issuance that exceeds either 5% of the number of shares of common stock or 5% of the voting power outstanding before the issuance. Under Rule 312.04(e) of the NYSE Listed Company Manual (“Rule 312.04(e)”), a shareholder is presumed to be a “substantial security holder” (and therefore, a “Related Party” for purposes of Rule 312.03(b)) if it owns either 5% or more of the number of shares of common stock or 5% or more of the voting power outstanding of a NYSE listed company.

Due to Kimmeridge’s beneficial ownership of approximately 13.4% of our outstanding shares of Common Stock as of September 3, 2021, Kimmeridge is a Related Party for purposes of Rule 312.03(b). Upon consummation of the transactions contemplated by the Exchange Agreement, the Company would issue to Kimmeridge New Common Stock equal to approximately 9.9% of the Company’s then-outstanding Common Stock. As a result, the issuance of the New Common Stock pursuant to the Exchange Agreement is subject to shareholder approval for purposes of complying with Rule 312.03(b).

Q: What is the effect of shareholder approval?

A:Upon shareholder approval of the Issuance Proposal and the satisfaction of the other closing conditions contained in the Exchange Agreement (as described below), the transactions contemplated by the Exchange Agreement would be consummated. As a result of the issuance of the New Common Stock pursuant to the Exchange Agreement, Kimmeridge would hold, in the aggregate, approximately 19.2% of our issued and outstanding Common Stock and the Company would acquire and then cancel $197.0 million of Second Lien Notes.

The transactions contemplated by the Exchange Agreement are intended to strengthen the Company’s financial position by accelerating deleveraging initiatives and reducing cash interest expense by approximately $20 million per year. In addition, the transactions will improve the standing of shareholders in the capital structure of the Company and enhance Callon’s access to debt capital markets, providing the opportunity for reductions in the corporate cost of capital.

Q: What will happen if the Company’s shareholders do not approve the Issuance Proposal?

A:If we do not obtain the requisite shareholder approval of the Issuance Proposal at the Special Meeting, the transactions contemplated by the Exchange Agreement will not be consummated. The New Common Stock will not be issued to Kimmeridge and the $197.0 million of Second Lien Notes owed by Kimmeridge will remain outstanding.

Q: Are there conditions to the closing of the transactions pursuant to the Exchange Agreement?

A:Yes. The closing of the transactions pursuant to the Exchange Agreement is subject to various closing conditions, including (i) for purposes of complying with Rule 312.03(b) of the NYSE Listed Company

Manual, approval of the Company’s shareholders of the issuance of New Common Stock to Kimmeridge, (ii) the closing of the Company’s previously announced acquisitions of certain producing oil and gas properties and undeveloped acreage in the Delaware Basin from Primexx (the “Primexx Transaction”), (iii) approval by the NYSE of the listing of the New Common Stock, (iv) the accuracy of each party’s representations and warranties, subject to certain materiality qualifiers and (v) the absence of any injunctions or orders preventing the Exchange.

If any of these conditions are not satisfied or waived, the transactions pursuant to the Exchange Agreement will not close and, as a result, (i) the New Common Stock will not be issued to Kimmeridge and (ii) the $197.0 million of Second Lien Notes owned by Kimmeridge will remain outstanding.

Q: How important is my vote?

A: Your vote “FOR” “our” or like terms).the Issuance Proposal is very important and you are encouraged to submit a proxy as soon as possible. The Annualtransactions contemplated by the Exchange Agreement cannot be completed without approval of the Issuance Proposal by the affirmative vote of the holders of a majority of the votes cast with regard to the Issuance Proposal at the Special Meeting.

Q: How does the Board recommend that I vote?

A:The Board has unanimously determined that the issuance to Kimmeridge of the New Common Stock is in the best interests of Callon and its shareholders. The Board unanimously recommends that you vote “FOR” the Issuance Proposal.

Q: When and where will the meeting take place?

A:The Special Meeting will be held on Thursday, May 12, 2016, 2021, at 9:00 a.m. CDT[a.m. // p.m.], Central daylight Time, at . You may register and attend the Special Meeting by following the instructions provided under the question “How do I attend the Special Meeting?”.

Q: Who may vote at the Special Meeting?

A:You may vote all of the shares of Common Stock that you owned at the close of business on the Record Date. On the Record Date, we had shares of Common Stock issued and outstanding and entitled to be voted at the Special Meeting. You may cast one vote for each share of Common Stock held by you on the Record Date on the Issuance Proposal.

Q: How do I attend the Special Meeting?

A:If you wish to attend the Special Meeting in person, you must present valid, government-issued picture identification. If your shares are held in the Grand Ballroomname of a bank, broker or other nominee and you plan to attend the Special Meeting, in order to be admitted you must present proof of your beneficial ownership of the Natchez Grand Hotel, 111 Broadway Street, Natchez, Mississippi 39120. This proxyCommon Stock, such as a bank or brokerage account statement, contains important information foror copy of your Voting Instruction Form or Proxy Card, indicating that you owned shares of our Common Stock at the close of business on the Record Date.

For safety and security reasons, no cameras, recording equipment, cellular telephones, electronic devices, large bags, briefcases or packages will be permitted in the Special Meeting. No banners, signs, firearms or weapons will be allowed in the meeting room. We reserve the right to consider when decidinginspect all items entering the meeting room.

Q: What is the difference between a shareholder of record and a beneficial owner?

A:Shareholder of Record: If your shares of Common Stock are registered directly in your name with Callon’s transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, to be the “shareholder of record.”

Beneficial Owner: If your shares of Common Stock are held by a nominee, you are considered the “beneficial owner” of shares held in “street name.” The Proxy Card has been forwarded to you by your nominee who is considered, with respect to those shares, to be the “shareholder of record.” As the beneficial owner, you have the right to direct your nominee on how to vote your shares by following their instructions for voting by telephone or on the mattersInternet or, if you specifically request a copy of the printed materials, you may use the Proxy Card included in such materials.

Q: How do I obtain electronic access to the proxy materials?

A: This Proxy Statement is available to shareholders free of charge at [www.[●].com]. If you hold your shares in street name, you may be able to elect to receive future annual reports or proxy statements electronically. For information regarding electronic delivery you should contact your brokerage firm, bank, trustee or other agent (each, a “nominee”).

Q: How do I vote?

A: Shareholder of Record: If you are a shareholder of record, there are four ways to vote:

•By Attending the Special Meeting. You may vote in person at the Special Meeting by requesting a ballot when you arrive. You must bring valid picture identification such as a driver’s license or passport and provide proof of stock ownership as of the Record Date.

•Via the Internet. You can vote via the Internet by going to the website address provided on your Proxy Card. You will need to use the control number appearing on your Proxy Card to vote via the Internet.

•By Telephone. You can also vote by telephone by calling the toll-free telephone number provided on your Proxy Card. You will need to use the control number appearing on your Proxy Card to vote by telephone. You may transmit your voting instructionsfrom any touch-tone telephone.

•By Mail. If you received a printed copy of the Proxy Card, you can vote by marking, dating and signing it, and returning it in the reply envelope provided. Please promptly mail your Proxy Card to ensure that we receive it prior to the closing of the polls at the Special Meeting.

Beneficial Owners: If you are a beneficial owner of shares held in “street name,” there are four ways to vote:

•By Attending the Special Meeting. You must obtain a “legal proxy” from the organization that holds your shares. A legal proxy is a written document that will authorize you to vote your shares held in “street name” at the Special Meeting. Please contact your nominee for instructions regarding obtaining a legal proxy. You must also bring valid picture identification such as a driver’s license or passport and provide proof of stock ownership as of the Record Date.

•Via the Internet. You can vote via the Internet by going to the website address provided on your Proxy Card. You will need to use the control number appearing on your Proxy Card to vote via the Internet. The availability of Internet voting may depend on the voting process of your nominee.

•By Telephone. You can also vote by telephone by calling the toll-free telephone number provided on your Proxy Card. You will need to use the control number appearing on your Proxy Card to vote by telephone. The availability of telephone voting may depend on the voting process of your nominee.

•By Mail. You can vote by marking, dating and signing a printed copy of the Proxy Card, and returning it in the reply envelope provided. Please promptly mail your Proxy Card to ensure that we receive it prior to the closing of the polls at the Special Meeting.

If you vote on the Internet or by telephone, you do not need to return your Proxy Card. Internet and telephone voting for shareholders will be available 24 hours a day, and will close at 11:59 p.m., Central Daylight Time, on , 2021. Even if you plan to attend the Special Meeting, the Company recommends that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Special Meeting.

Q: How do I vote shares of Callon Common Stock held in Callon’s 401(k) plan?

A. If your shares of Callon Common Stock are held in Callon’s Employee Savings and Protection Plan (“Callon’s 401(k) plan”), you will receive an email from the plan administrator with voting instructions. The trustee of Callon’s 401(k) plan will vote your shares of Callon Common Stock in accordance with your directions.

If you do not timely direct the trustee how to vote your shares in the Callon 401(k) plan, or if you do not direct the trustee, the trustee of Callon’s 401(k) plan will vote your shares of Callon Common Stock in proportion to the voting directions received from all plan participants who properly vote. Please note that votes for shares held in Callon’s 401(k) plan have an earlier voting deadline. Please review the instructions for the date by which your voting directions must be received in order for your shares of Callon Common Stock to be voted as you direct.

In the case of internet or telephone voting, you should have your voting instructions in hand until you have completed the voting process.

Please note that no votes will be accepted at the Special Meeting in respect of shares of Callon Common Stock held in Callon’s 401(k) plan and that all such votes must be voted prior to the Callon Special Meeting.

Q:What constitutes a quorum, and why is a quorum required?

A:Under our Amended and Restated Bylaws, we are required to have a quorum of shareholders present for the Issuance Proposal to be voted at the Special Meeting. The presence at the Special Meeting, in person or by proxy, of the holders of a majority of the stock issued and outstanding and entitled to vote as of the Record Date will constitute a quorum, permitting us to conduct the business of the Special Meeting. Proxies received but marked as abstentions as well as broker non-votes (as described below), if any, will be included in the calculation of the number of shares considered to be present at the Special Meeting for quorum purposes. If we do not have a quorum present or represented, then the Chairman of the Special Meeting or the shareholders present or represented by proxy and entitled to vote at the Special Meeting may adjourn the meeting from time to time, as authorized by our Amended and Restated Bylaws, until a quorum is present.

Q:How many votes are needed to approve the Issuance Proposal?

A:Approval of the Issuance Proposal requires the affirmative vote of the holders of a majority of the votes cast with regard to the Issuance Proposal at the Special Meeting, if a quorum is present. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but

will not be included in determining the number of votes cast and will have no effect upon the outcome of the vote on the Issuance Proposal.

Pursuant to the Exchange Agreement, Kimmeridge has agreed to vote all shares of Common Stock beneficially owned by it as of the Record Date in favor of the Issuance Proposal. In connection with the execution of the Exchange Agreement, each of the Company’s executive officers and directors also entered into a Voting Agreement, dated as of the date of the Exchange Agreement (the “Voting Agreement”). On the terms and conditions set forth in the Voting Agreement, our executive officers and directors agreed to vote all of the shares of Common Stock over which they have voting power (representing in the aggregate approximately 2% of the Company’s total outstanding voting power as of August 3, 2021) in favor of the Issuance Proposal. The Voting Agreement is attached hereto as Annex B.

Additionally, pursuant to those certain purchase and sale agreements, dated as of August 3, 2021, between the Company and Callon Petroleum Operating Company and Primexx Resource Development LLC and BPP Acquisition, LLC, respectively (collectively, “Primexx”) executed in connection with the Primexx Transaction, Primexx has agreed to vote shares of Common Stock over which they will have voting power (estimated to be 9.19 million shares, subject to purchase price adjustments pursuant to the purchase and sale agreements) in favor of the Issuance Proposal. In the aggregate, the foregoing voting agreements represent approximately 16 million, or approximately 30%, of the shares anticipated to be outstanding on the Record Date.

Q:What if I sign and return my proxy without making any selections?

A:If you sign and return your Proxy Card without making any selections, your shares will be voted “FOR” the Issuance Proposal.

Q: What if I am a beneficial owner and I do not give the nominee voting instructions?

A:If you are a beneficial owner and your shares are held in the name of a broker or other nominee, such broker or nominee is bound by the rules of the NYSE regarding whether or not it can exercise discretionary voting power for any particular proposal if the broker has not received voting instructions from you. Brokers have discretionary authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the beneficial owner of the shares. The Issuance Proposal is not considered a “routine” matter; accordingly, if you hold your shares of Common Stock through a broker or other nominee, and you return your voting instruction card without providing voting instructions, your nominee will not have discretionary authority to vote your shares of Common Stock.

Q: Can I change my vote after I have delivered my Proxy Card?

A:Yes. You may revoke your Proxy Card at any time before its exercise. You may also revoke your proxy by (i) voting in person at the Special Meeting, (ii) delivering to the Corporate Secretary (at our principal executive offices in Houston, Texas) a revocation of proxy or (iii) executing a new proxy bearing a later date. If you are a beneficial owner, you must contact your nominee to change your vote or obtain a proxy to vote your shares if you wish to cast your vote in person at the Special Meeting.

Q: If I plan to attend the Special Meeting, should I still vote by proxy?

A:Yes. Casting your vote in advance does not affect your right to attend the Special Meeting.

If you vote in advance and also attend the Special Meeting, you do not need to vote again at the Special Meeting unless you want to change your vote. Written ballots will be available at the Special Meeting for shareholders of record.

Q: What happens if I sell or otherwise transfer my shares of Common Stock before the Special Meeting?

A: The Record Date is prior to the date of the Special Meeting. If you sell or otherwise transfer your shares of Common Stock after the Record Date but before the Special Meeting, unless special arrangements are made between you and the person to whom you transfer your shares of Common Stock (such as provision of a proxy), you will retain your right to vote such shares at the Special Meeting but will otherwise transfer ownership of and the economic interest in your shares of Common Stock.

Q: Will any other business be conducted at the Special Meeting?

A: Callon will transact no other business at the Special Meeting, except such business as may properly be brought before the meeting. Please readSpecial Meeting or any adjournments or postponements thereof by or at the direction of the Board in accordance with Callon’s bylaws.

Q: Where can I find voting results of the Special Meeting?

A:We will announce the results for the proposals voted upon at the Special Meeting and publish final detailed voting results in a Form 8-K filed with the Securities and Exchange Commission (the “SEC”) within four business days after the Special Meeting.

Q: Am I entitled to dissenter’s rights?

A:No. Delaware General Corporation Law (the “DGCL”) does not provide for dissenter’s rights in connection with the Issuance Proposal being voted on at the Special Meeting.

Q: Am I entitled to preemptive rights?

A:No. Under the DGCL and our Certificate of Incorporation, as amended, shareholders are not entitled to any preemptive rights in connection with the issuance of the New Common Stock to Kimmeridge.

Q: Who should I call with other questions?

A:If you need assistance voting your shares, please contact Investor Relations at (281) 589-5200. If you have additional questions about this Proxy Statement or the Special Meeting or would like additional copies of this Proxy Statement or the Proxy Card, please contact our proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York NY 10022.

Banks and Brokerage Firms, please call: (281) 589-5200

Shareholders, please call toll-free: (888) 750-5834

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Proxy Statement includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements in this Proxy Statement by words such as “anticipate,” “project,” “intend,” “estimate,” “expect,” “believe,” “predict,” “budget,” “projection,” “goal,” “plan,” “forecast,” “target” or similar expressions.

All statements, other than statements of historical facts, included in this Proxy Statement and the information incorporated by reference that address activities, events or developments that we expect or anticipate will or may occur in the future are forward-looking statements, including such things as:

•our oil and natural gas reserve quantities, and the discounted present value of these reserves;

•the amount and nature of our capital expenditures;

•our future drilling and development plans and our potential drilling locations;

•the timing and amount of future capital and operating costs;

•production decline rates from our wells being greater than expected;

•commodity price risk management activities and the impact on our average realized prices;

•business strategies and plans of management;

•our ability to consummate and efficiently integrate recent acquisitions; and

•prospect development and property acquisitions.

We caution you that the forward-looking statements contained or incorporated by reference in this Proxy Statement are subject to all of the risks and uncertainties, many of which are beyond our control, incident to the exploration for and development, production and sale of oil and natural gas. These and other risks include, but are not limited to, the risks described in Part I, Item 1A of our 2020 Annual Report on Form 10-K and in all Quarterly Reports on Form 10-Q filed subsequently thereto. These factors include:

•volatility of oil, natural gas and natural gas liquids (“NGLs”) prices or a prolonged period of low oil, natural gas or NGLs prices;

•general economic conditions including the availability of credit and access to existing lines of credit;

•changes in the supply of and demand for oil and natural gas, including as a result of the COVID-19 pandemic and various governmental actions taken to mitigate its impact or actions by, or disputes among, members of OPEC and other oil and natural gas producing countries, such as Russia, with respect to production levels or other matters related to the price of oil;

•the uncertainty of estimates of oil and natural gas reserves;

•impairments;

•the impact of competition;

•the availability and cost of seismic, drilling and other equipment, waste and water disposal infrastructure, and personnel;

•operating hazards inherent in the exploration for and production of oil and natural gas;

•difficulties encountered during the exploration for and production of oil and natural gas;

•the potential impact of future drilling on production from existing wells;

•difficulties encountered in delivering oil and natural gas to commercial markets;

•the uncertainty of our ability to attract capital and obtain financing on favorable terms;

•compliance with, or the effect of changes in, the extensive governmental regulations regarding the oil and natural gas business including those related to climate change and greenhouse gases;

•the impact of government regulation, including regulation of hydraulic fracturing and water disposal wells;

•any increase in severance or similar taxes;

•the financial impact of accounting regulations and critical accounting policies;

•the comparative cost of alternative fuels;

•credit risk relating to the risk of loss as a result of non-performance by our counterparties;

•cyberattacks on the Company or on systems and infrastructure used by the oil and natural gas industry; and

•weather conditions.

In addition, there are risks and uncertainties relating to the Primexx Transaction, which include the following:

•the purchase and sale agreements relating to the Primexx Transaction may be terminated in accordance with their respective terms or the parties thereto may not be able to satisfy the conditions to completion of the Primexx Transaction, in which case the Primexx Transaction may not be completed;

•the Primexx Transaction may not be accretive, and may be dilutive, to Callon’s earnings per share, which may negatively affect the market price of Callon Common Stock;

•Callon may incur significant transaction and other costs in connection with the Primexx Transaction and the transactions pursuant to the Exchange Agreement in excess of those anticipated by Callon; and

•the ultimate timing, outcome, and results of integrating the assets acquired in the Primexx Transaction.

Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. Additional risks or uncertainties that are not currently known to us, that we currently deem to be immaterial, or that could apply to any company could also materially adversely affect our business, financial condition, or future results. Any forward-looking statement speaks only as of the date of which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

In addition, we caution that reserve engineering is a process of estimating oil and natural gas accumulated underground and cannot be measured exactly. Accuracy of reserve estimates depend on a number of factors including data available at the point in time, engineering interpretation of the data, and assumptions used by the reserve engineers as it

carefully.relates to price and cost estimates and recoverability. New results of drilling, testing, and production history may result in revisions of previous estimates and, if significant, would impact future development plans. As such, reserve estimates may differ from actual results of oil and natural gas quantities ultimately recovered.

Except as required by applicable law, all forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC (File No. 001-14039). The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the site is http://www.sec.gov.

We also make available free of charge on our website, at www.callon.com under the “Investor” section, all of the documents that we file with the SEC as soon as reasonably practicable after we electronically file those documents with the SEC. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Proxy Statement, and you should not consider such information as part of this Proxy Statement.

Information Incorporated by Reference

We “incorporate by reference” into this Proxy Statement certain information we file with the SEC, which means that we can disclose important information to you by referring you to that information. The information incorporated by reference is considered to be part of this Proxy Statement, and later information that we file with the SEC will automatically update and supersede that information. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, until the date of the Special Meeting (unless otherwise stated, other than information furnished under Items 2.02 or 7.01 of any Form 8-K, which is not deemed filed):

•our Annual Report on Form 10-K for the year ended December 31, 2020 filed on February 25, 2021;

•our Quarterly Reports on Form 10-Q for the three months ended March 31, 2021 filed on May 6, 2021, and for the six months ended June 30, 2021 filed on August 4, 2021; and

•our Current Reports on Form 8-K filed on March 16, 2021, April 16, 2021, May 11, 2021, May 14, 2021, June 21, 2021, June 22, 2021, July 7, 2021, July 23, 2021, August 5, 2021 and August 5, 2021.

Any statement contained in this Proxy Statement or in a document incorporated or deemed to be incorporated by reference in this Proxy Statement shall be deemed to be modified or superseded for purposes of this Proxy Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this offering memorandum.

You may obtain any of the documents incorporated by reference in this Proxy Statement from the SEC through the SEC’s website at the address provided above. We will provide you a copy of this Proxy Statement or any or all of the information that has been incorporated by reference in this Proxy Statement (including exhibits to those documents specifically incorporated by reference in this document), at no cost, upon your written or oral request to us at the following address or telephone number:

Callon Petroleum Company

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, TX 77042

Telephone: (281) 589-5200

Attn: Investor Relations

If you would like to request any documents, please do so by , 2021, which is five business days prior to the date of the Special Meeting, in order to receive them before the meeting.

THE ISSUANCE PROPOSAL

Overview and Reason for the Issuance Proposal

On August 3, 2021, the Company, entered into the Exchange Agreement by and among the Company and Kimmeridge, as holder of the Second Lien Notes. Pursuant to the Exchange Agreement, Kimmeridge agreed to exchange, on the Closing Date (as defined in the Exchange Agreement), $197.0 million in aggregate principal amount of Second Lien Notes held by Kimmeridge for 5,512,623 shares of New Common Stock (which equals a notional amount of approximately $223.1 million of New Common Stock as of August 3, 2021). Kimmeridge’s current holdings in the Company’s Second Lien Notes and all but 602,503 shares of Common Stock were obtained as part of concurrent transactions agreed to in September 2020 whereby Kimmeridge purchased Second Lien Notes, warrants for Common Stock, and an overriding royalty interest in substantially all Callon-operated oil and gas leaseholds as of the effective date of such transactions. Kimmeridge’s remaining shares of Common Stock were purchased in the open market.

The closing of the transactions pursuant to the Exchange Agreement is subject to various closing conditions, including (i) for purposes of complying with Rule 312.03(b), approval of the Company’s shareholders of the issuance of New Common Stock to Kimmeridge, (ii) the closing of the Primexx Transaction, (iii) approval by the NYSE of the listing of the New Common Stock, (iv) the accuracy of each party’s representations and warranties, subject to certain materiality qualifiers and (v) the absence of any injunctions or orders preventing the Exchange. If any of these conditions are not satisfied or waived, the transactions pursuant to the Exchange Agreement will not close and, as a result, (i) the New Common Stock will not be issued to Kimmeridge and (ii) $197.0 million of Second Lien Notes owned by Kimmeridge will remain outstanding.

The Exchange Agreement may be terminated (i) upon the mutual consent of the parties thereto, (ii) by either party if the Exchange has not been consummated by December 31, 2021 (the “Outside Date”), (iii) by either party in the event of an order, judgment or decree delaying the closing beyond the Outside Date and (iv) by either party if the other party materially breaches the Exchange Agreement.

The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the Exchange Agreement, which is attached hereto as Annex A.

We are seeking shareholder approval of the Issuance Proposal in order to comply with Rule 312.03(b) with respect to the issuance of the New Common Stock pursuant to the Exchange Agreement. Our Common Stock is listed on the NYSE, and thus, we are subject to NYSE listing requirements. Under Rule 312.03(b), shareholder approval is required prior to any issuance or sale of common stock in any transaction or series of related transactions (i) to a Related Party if the number of shares of common stock to be issued exceeds either 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance or (ii) when a Related Party has a 5% or greater interest, directly or indirectly, in the company or in the consideration to be paid in the transaction or series of related transactions, and the present or potential issuance of common stock could result in an issuance that exceeds either 5% of the number of shares of common stock or 5% of the voting power outstanding before the issuance. Under Rule 312.04(e), a shareholder is presumed to be a “substantial security holder” (and therefore, a “Related Party” for purposes of Rule 312.03(b)) if it owns either 5% or more of the number of shares of common stock or 5% or more of the voting power outstanding of a NYSE listed company.

Due to Kimmeridge’s beneficial ownership of approximately 13.4% of our outstanding shares of Common Stock as of September 3, 2021, Kimmeridge is a Related Party for purposes of Rule 312.03(b). Upon consummation of the transactions contemplated by the Exchange Agreement, the Company would issue to Kimmeridge New Common Stock equal to approximately 9.9% of the Company’s then-outstanding Common Stock. As a result, the issuance of the New Common Stock pursuant to the Exchange Agreement is subject to shareholder approval for purposes of complying with Rule 312.03(b). Approval of the Issuance Proposal requires the affirmative vote of the holders of a majority of the votes cast with regard to the Issuance Proposal at the Special Meeting, if a quorum is present.

The terms of the Exchange Agreement were negotiated between the parties on an arms-length basis. Neither Kimmeridge nor any of its affiliated entities has Board representation or any other governance rights with respect to the Company. The value of Common Stock to be delivered was based on the construct of the optional

redemption language in the Second Lien Notes Indenture. The price of the Common Stock used to calculate the Common Stock issued was based on the 10-day volume-weighted average price as of August 2, 2021, which was the 10-day period prior to execution of the Exchange Agreement.

The Exchange Agreement was unanimously approved by the Board upon the recommendation of the independent Nominating & ESG Committee of the Board, which is responsible for review of related party transactions for the Company.

The Board believes that the transactions contemplated by the Exchange Agreement will strengthen the Company’s financial position by accelerating deleveraging initiatives and reducing cash interest expense by approximately $20 million per year. In addition, the transactions will improve the standing of shareholders in the capital structure of the Company and enhance Callon’s access to debt capital markets, providing the opportunity for reductions in the corporate cost of capital.

The Voting Agreements

In connection with the execution of the Exchange Agreement, each of our executive officers and directors entered into the Voting Agreement. On the terms and conditions set forth in the Voting Agreement, our executive officers and directors agreed to vote all of the shares of Common Stock over which they have voting power (representing in the aggregate approximately 2% of the Company’s total outstanding voting power as of the Record Date) in favor of the Issuance Proposal. The foregoing description of the Voting Agreement is qualified in its entirety by reference to the Voting Agreement, which is attached hereto as Annex B.

Kimmeridge has also agreed, pursuant to the Exchange Agreement, to vote all of the shares of Common Stock for which it has voting power in favor of the Issuance Proposal. Additionally, Kimmeridge agreed, pursuant to the Exchange Agreement, not to transfer any Second Lien Notes and substantially all of the Common Stock beneficially held by it until the closing of the transactions pursuant to the Exchange Agreement, subject to certain exceptions, including (i) transfers of Common Stock to Affiliates who agree in writing to be bound by the Exchange Agreement and deliver an executed written agreement to that effect to the Company prior to such transfer, (ii) transfers of up to 500,000 shares of Common Stock, and (iii) transfers of Common Stock with the prior written consent the Company. As of September 3, 2021, Kimmeridge was the beneficial owner of 6,188,157 shares of Common Stock, representing approximately 13.4% of the Company’s total outstanding voting power. Additionally, pursuant to the purchase and sale agreements executed in connection with the Primexx Transaction, Primexx has also agreed to vote all shares of Common Stock over which they will have voting power (estimated to be 9.19 million shares, subject to purchase price adjustments pursuant to the purchase and sale agreements) in favor of the Issuance Proposal.

In the aggregate, the foregoing voting agreements represent approximately 16 million, or approximately 30%, of the shares anticipated to be outstanding on the Record Date.

Registration Rights Agreement

In connection with the execution of the Exchange Agreement and issuance of New Common Stock thereunder, the Company and Kimmeridge agreed to enter into a registration rights agreement (the “Registration Rights Agreement”) pursuant to which the Company is required to, subject to certain exceptions, prepare and file a registration statement under the Securities Act with the Securities and Exchange Commission, within three business days of the Closing Date (as defined in the Exchange Agreement), in order to permit the public resale of the New Common Stock. The Registration Rights Agreement will also include certain customary demand rights for underwritten offerings and piggyback rights.

RECOMMENDATION OF THE BOARD

THE BOARD RECOMMENDS A VOTE “FOR”

THE APPROVAL OF THE ISSUANCE PROPOSAL

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets forth beneficial ownership information with respect to our Common Stock as of September 3, 2021 for (i) each person known by us to beneficially own 5% or more of our outstanding Common Stock; (ii) each of ournamed executive officers (“NEOs”), (iii) each of our directors, and (iv) all of our directors and executive officers as of the Record Date, as a group. Unless otherwise noted, each person listed below has sole voting and investment power with respect to the shares of our Common Stock listed below as beneficially owned by the person. Information set forth in the table with respect to beneficial ownership of Common Stock has been obtained from filings made by the named beneficial owners with the SEC as of September 3, 2021, or, in the case of our executive officers and directors, has been provided to us by such individuals. As of September 3, 2021, the Company had 46,290,611 shares outstanding.

None of the shares beneficially owned by our executive officers or directors has been pledged as security for an obligation. Our Insider Trading Policy prohibits our executive officers and directors from holding Callon securities in a margin account or pledging Callon securities as collateral for a loan.

| | | | | | | | |

| Beneficial Ownership |

| Name of Beneficial Owner | Shares (#) | Percent of Class |

| Holders of More Than 5%: (1) | | |

| Kimmeridge Energy Management Company, LLC(2) | 6,188,157 | 13.4% |

| BlackRock, Inc.(3) | 4,415,315 | 9.5% |

| JB Investments Management, LLC(4) | 3,055,211 | 6.6% |

| | |

| Named Executive Officers: | | |

| Joseph C. Gatto, Jr.(5) | 75,457 | * |

| Kevin Haggard(6) | – | – |

| Jeffrey S. Balmer(7) | 8,480 | * |

| Michol L. Ecklund(8) | 9,482 | * |

| Gregory F. Conaway(9) | 34,289 | * |

| James P. Ulm, II(10) | 15,428 | * |

| Directors: | | |

| Frances Aldrich Sevilla-Sacasa(11) | 4,384 | * |

| Matthew R. Bob | 12,236 | * |

| Barbara J. Faulkenberry | 8,798 | * |

| Michael L. Finch | 9,081 | * |

| L. Richard Flury(12) | 33,895 | * |

| S. P. Johnson IV(13) | 150,094 | * |

| Larry D. McVay(14) | 24,635 | * |

| Anthony J. Nocchiero | 18,021 | * |

| James M. Trimble | 10,336 | * |

| Steven A. Webster(15) | 763,596 | 1.6% |

All Executive Officers and Directors as a Group (consisting of 16 persons)(16) | 1,178,212 | 2.5% |

*Less than 1%.

(1)Pursuant to the purchase and sale agreements executed in connection with the Primexx Transaction, Primexx Resource Development, LLC and BPP Acquisition, LLC are expected to receive an estimated 9.19 million shares, subject to purchase price adjustments pursuant to the purchase and sale agreements and the closing of the transactions contemplated thereby.

(2)Kimmeridge EMC, in its capacity as an investment adviser to Kimmeridge, exercises voting and investment control over the securities held by Kimmeridge. Kimmeridge EMC has shared voting and shared dispositive power over 5,585,654 shares. Kimmeridge does not have sole voting or sole dispositive power over any shares. Kimmeridge EMC’s address is 412 West 15 Street, 11th Floor, New York, NY 10011. This information is based on Kimmeridge EMC’s most recent Statement on Schedule 13G filed on March 5, 2021.

(3)BlackRock, Inc. (“BlackRock”), in its capacity as a parent holding company or control person for various subsidiaries (none of which individually owns more than 5% of our outstanding Common Stock), may be deemed to beneficially own the indicated shares. BlackRock has sole voting power over 4,404,928 shares and sole dispositive power over 4,415,315 shares. BlackRock does not have shared voting or shared dispositive power over any of the shares. BlackRock’s address is 55 East 52nd St., New York, NY 10055. This information is based on BlackRock’s most recent Statement on Schedule 13G filed on February 5, 2021.

(4)JB Investments Management, LLC (“JB Investments”), in its capacity as an investment adviser, may be deemed to beneficially own the indicated shares, along with JB Investments Fund III, L.P., JB Investments Parallel Fund III, L.P. (together with JB Investments Fund III, L.P., the “Funds”). JB Investments Fund III GP, LLC is the general partner of, and may be deemed to beneficially own securities owned by the Funds. Mr. Brian J. Riley is the sole manager of, and may be deemed to beneficially own securities owned by JB Investments. JB Investments has shared voting and shared dispositive power over 3,055,211 shares. JB Investment’s address is 355 Valley Park Road, Phoenixville, PA 19460. This information is based on JB Investment’s most recent Statement on Schedule 13G filed on May 10, 2021.

(5)Comprised of 68,844 shares held directly by Mr. Gatto and 6,613 shares held indirectly within the 401(k) Plan. Does not include 92,278 unvested restricted stock units (“RSUs”) payable in stock and 104,896 unvested performance stock units (“PSUs”) payable in 50% stock and 50% cash.

(6) Mr. Haggard holds has 32,406 unvested RSUs.

(7) Comprised of 8,467 shares held directly by Dr. Balmer and 13 shares held indirectly within the 401(k) Plan. Does not include 44,604 unvested RSUs payable in stock and 47,412 unvested PSUs payable in 50% stock and 50% cash.

(8)Comprised of 9,422 shares held directly by Ms. Ecklund and 60 shares held indirectly within the 401(k) Plan. Does not include 27,847 unvested RSUs payable in stock and 29,152 unvested PSUs payable in 50% stock and 50% cash.

(9)Comprised of 34,829 shares held directly by Mr. Conaway. Does not include 13,316 unvested RSUs payable in stock and 8,046 unvested PSUs payable in 50% stock and 50% cash.

(10) Comprised of 15,371 shares held directly by Mr. Ulm and 57 shares held indirectly within the 401(k) Plan.

(11)Comprised of 4,384 shares held directly by Ms. Aldrich Sevilla-Sacasa, which includes 2,037 vested deferred RSUs, pursuant to Ms. Aldrich Sevilla-Sacasa’s election under the Deferred Compensation Plan for Outside Directors, which are payable in cash upon her separation of service as a director. Does not include 3,240 unvested deferred RSUs, pursuant to Ms. Aldrich Sevilla-Sacasa’s election under the Deferred Compensation Plan for Outside Directors, which are payable in cash upon her separation of service as a director.

(12)Comprised of 30,895 shares held directly by Mr. Flury and 3,000 shares held in a joint tenancy with his spouse, which includes 15,559 vested deferred RSUs, pursuant to Mr. Flury’s election under the Deferred Compensation Plan for Outside Directors, which are payable in cash upon his separation of service as a director.

(13)Comprised of 80,094 shares held directly by Mr. Johnson and 70,000 shares held indirectly with a Family Limited Partnership, which includes 15,229 vested deferred RSUs, pursuant to Mr. Johnson’s election under the Deferred Compensation Plan for Outside Directors, which are payable in cash upon his separation of service as a director.

(14)Comprised of 24,635 shares held directly by Mr. McVay, which includes 3,501 vested deferred RSUs, pursuant to Mr. McVay’s election under the Deferred Compensation Plan for Outside Directors, which are payable in cash upon his separation of service as a director.

(15)Comprised of 549,721 shares held directly by Mr. Webster, 64,500 shares held indirectly with his spouse, and 149,375 shares held indirectly through San Felipe Resources Company, which includes 13,192 vested deferred RSUs, pursuant to Mr. Webster’s election under the Deferred Compensation Plan for Outside Directors, which are payable in Common Stock upon his separation of service as a director.

(16) Comprised of 884,594 shares held directly by the Company’s executive officers and directors, 3,000 shares held in a joint tenancy, 64,500 shares held indirectly by a spouse, 70,000 shares held indirectly by a Family Limited Partnership, 6,743 shares held indirectly within the Company’s 401(k) Plan, and 149,375 shares held indirectly by San Felipe Resources Company.

OTHER MATTERS

Requirements, including Deadlines, for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders

In order for a proposal to be considered for inclusion in the proxy statement for the 2022 Annual Meeting of Shareholders (the “2022 Annual Meeting”) pursuant to Rule 14a-8 of the Exchange Act, such proposal must be received by the Secretary of the Company at our principal executive offices no later than December 10, 2021 (assuming the date of the 2022 Annual Meeting has not been changed by more than 30 days from the date of the 2021 Annual Meeting of Shareholders), and must otherwise be in compliance with the requirements of the SEC’s proxy rules. If the date of the 2022 Annual Meeting has been changed by more than 30 days from the date of this Annual Meeting, then the deadline is a reasonable time before we begin to print and send our proxy materials for the 2022 Annual Meeting.

For a shareholder proposal to be introduced for consideration at the 2022 Annual Meeting but not intended to be considered for inclusion in the Company’s proxy statement and form of proxy relating to such meeting (i.e. not pursuant to Rule 14a-8 of the Exchange Act), including shareholder nominations for candidates for election as directors, a shareholder must provide written notice of such proposal to the Company not later than 120 days nor earlier than 150 days before the date of the 2022 Annual Meeting. Any such notice must describe the shareholder proposal in reasonable detail and otherwise comply with the requirements set forth in our bylaws.

Nominating Process

In accordance with our certificate of incorporation and bylaws, any shareholder may nominate a person for election to the Board upon delivery of written notice to us of such nomination. Such notice must be sent as provided in our certificate of incorporation and bylaws on or before the deadline set forth in our certificate of incorporation and bylaws and must otherwise comply with the procedures set forth in our certificate of incorporation. For nominations, the Board will consider individuals identified by shareholders on the same basis as nominees identified from other sources. A submission recommending a nominee should include:

•Sufficient biographical information to allow the Nominating & ESG Committee to evaluate the qualifications of a potential nominee in light of the director nomination procedures and criteria and any other information that would be required to be disclosed in solicitations of proxies for the election of directors;

•An indication as to whether the proposed nominee will meet the requirements for independence under NYSE and SEC guidelines;

•A description of all direct and indirect compensation and other material monetary agreements, arrangements, and understandings during the past three years, and any other material relationships, between or among the nominating shareholder or beneficial owner and each proposed nominee;

•A completed and signed questionnaire, representation, and agreement, pursuant to our bylaws, with respect to each nominee for election or re-election to the Board; and

•The proposed nominee’s written consent to serve if nominated and elected.

Other than the Issuance Proposal described in this Proxy Statement, there are no other matters to be considered at the Special Meeting.

List of Shareholders Entitled to Vote at the Special Meeting

The names of shareholders of record entitled to vote at the Special Meeting will be available at the Company’s principal office in Houston, Texas, for a period of ten (10) days prior to the Special Meeting and continuing through the Special Meeting.

Expenses Relating to this Proxy Solicitation

The Board will primarily solicit proxies by mail, and we will bear all costs incurred in the solicitation of proxies, including the preparation, printing and mailing of these proxy materials. In addition to solicitation by mail, our

Directors,directors, officers and employees may solicit proxies personally or by telephone, email, facsimile or other means, without additional compensation. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of the

common stockCommon Stock held by such persons, and we may reimburse those brokerage houses and other custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith. In addition, to assist us with our solicitation efforts, we have retained the services of

Morrow & Co., LLCInnisfree M&A Incorporated for a fee of approximately

$7,500,$15,000, plus out-of-pocket expenses.

INFORMATION ABOUT VOTING AND THE MEETING

Who may vote

You may vote if you are the record

ANNEX A

Execution Version

EXCHANGE AGREEMENT

THIS EXCHANGE AGREEMENT (this “Agreement”) is made and entered into as of August 3, 2021 (the “Execution Date”) by and among Callon Petroleum Company, a Delaware corporation (the “Company”) and Chambers Investments, LLC a Delaware limited liability company (“Kimmeridge”) as holder of ourthe Company’s 9.00% Second Lien Senior Secured Notes due 2025 (the “Second Lien Notes”), issued pursuant to the Indenture, dated as of September 30, 2020 (the “Second Lien Notes Indenture”), by and among the Company, the subsidiary guarantors named therein and U.S. Bank National Association, as trustee and collateral agent (in such capacity, the “Second Lien Notes Trustee”).

RECITALS

WHEREAS, subject to the terms and conditions set forth herein, the Company desires to issue to Kimmeridge, in exchange for the Exchanged Notes (as defined herein), new shares of common stock, par value $0.01, of the Company (the “Common Stock”), and grant certain registration rights to Kimmeridge pursuant to the registration rights agreement substantially in the form attached hereto as Exhibit A (the “Registration Rights Agreement”).

NOW, THEREFORE, subject to the premises and other conditions contained herein, the parties hereto hereby agree as follows:

ARTICLE I

EXCHANGE OF NOTES

Section 1.1 Exchange of Exchanged Notes.

(a) Subject to the terms and conditions set forth in this Agreement, at the Closing, Kimmeridge shall assign, transfer and deliver to the Company all of its right, title and interest in and to all of the Second Lien Notes held by Kimmeridge as of the closedate hereof, as set forth on Schedule I hereto (the “Exchanged Notes”), free and clear of business on March 18, 2016,any Lien (as defined herein).